By Jamie Hopkins, Managing Director, Wealth Services

Sonu Varghese, Director, Investment Platforms; and Ryan Detrick, Chief Market Strategist, contributed to this report.

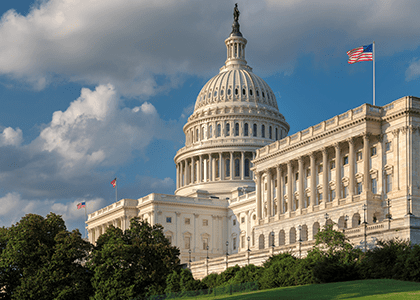

Senate Democrats have reached a general agreement on a bill to address climate change, taxes, health care, inflation and the deficit, according to a White House statement.

This agreement came as a surprise to many after the Build Back Better Act of 2021 was unable to gain enough traction in the Senate. But after months of negotiations, Senate Democrats have released a text of the bill, 725 pages, outlining the new spending and tax revenue provisions.

The bill is not yet finalized, though it appears lawmakers are motivated to take action before the midterm elections. And because Democrats plan to pass the bill through budget reconciliation, it can avoid a filibuster and pass in the Senate with a simple majority.

The Senate plans to address the bill next week before the Senate breaks. The bill would then need to pass through the House before it lands on President Joe Biden’s desk for a signature.

The major provisions of this bill include:

- Installing a 15% minimum corporate tax revenue for certain large firms

- Medicare and prescription drug reform

- Spending to increase IRS enforcement and efficiency to enable more audits of companies and high-income individuals and to cut back on fraud

- Closing the carried interest loophole

- Lowering drug and health care costs through expansion of the Affordable Care Act

- Expansion of Medicare Part D Low Income Subsidies

- Tax credits for electric cars and other energy investments

- Investments into clean and renewable energy and environmental issues

Though the bill’s official moniker is the Inflation Reduction Act of 2022, how much the bill will directly impact inflation today or in the long run is up for debate.

There are areas of the bill that may help with inflation. For example, the drug pricing provisions are very deflationary – especially for the PCE price index (the Fed’s preferred indicator), since medical costs are a big part of that.

In addition, tax increases tend to be deflationary, since they pull money out of the private sector. This also applies to the IRS funding, which provides extra money for increasing compliance, (i.e., raising tax revenue).

On the other end, the spending provisions could be inflationary. If the energy- and climate-related policies raise investment, then that’s a productivity boost. That said, the transition from fossil fuels to more carbon-neutral fuels could be rough and inflationary. One item not addressed in the bill is reform to speed up permitting for energy infrastructure, since it can’t be passed through budget reconciliation. It’s expected to be addressed in separate legislation in the fall.

The budget impact of this bill is expected to raise tax revenue and decrease the deficit over the next 10 years by about $300 billion.

It is just as important to talk about what the bill doesn’t do. According to the White House and Senate Democrats, this bill will not raise taxes on any Americans making less than $400,000 a year. Additionally, the bill does not include any expanded child tax credits, capital gains rate hikes, free college or paid leave provisions that were found in the Build Back Better Act.

This bill would represent a revenue increase for the government, potentially reduce the deficit and make significant investments into health care costs and energy sectors. Remember, this is not a final bill and could still see changes or roadblocks ahead.

Jamie Hopkins is not affiliated with Cetera Advisor Networks, LLC